📌课程内容:

1. 6 months relaxation period

2. MyInvois Portal – Practical issue and guide

3. Trading with MSME – revenue below RM150,000

4. Submission of return to LHDN – factors to consider

5. Cut-off issue during transition period

6. Variances in accounting vs MyInvois

7. Recommendations on implementation fundamental stage

8. Recommendations on commonly face operational issues.

9. E-invoice impact to income tax deductions

10. Practical cases and solutions

11. Overview of e-invoice

12. Types of transactions

13. Implementation timeline / Exemptions from implementing e-Invoice

14. E-Invoice workflow

15. Complications in transitioning from traditional to digital workflows

16. E-Invoice model (MyInvois vs API) / E-Invoice format

17. Transactions with buyers

18. Disbursement vs reimbursement Employee’s benefits

19. Self-billed invoice

Premium Learning

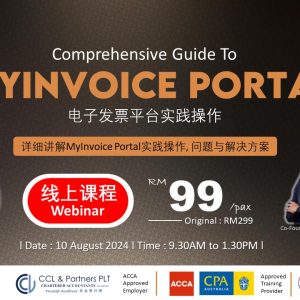

🌟【电子发票实行全攻略】🌟 Online站

RM459.00

🌟【电子发票实行全攻略】🌟 Online站

✅ 线上研讨会

✅ 全面落地实行讲解

电子发票第1阶段已经实行数月,虽然政府给予6个月的宽松期,但很多企业老板仍然面临许多实行上的奇难杂症,挑战和障碍。😰

❌ 会计软件功能不成熟

❌ 员工不了解电子发票

❌ 企业没有清晰的实行指南,等等问题

这些问题让企业主们苦恼不已!😓 电子发票不仅影响企业运作,更对经济大环境产生深远影响。企业必须提前准备,做好万全之策!

📣 来参加我们的研讨会,深入解析如何解决电子发票实行中的问题!通过实践案例和方案,让你轻松上手,顺利过渡!🎯 掌握电子发票的秘密,助力企业腾飞!💼🚀

Reviews

There are no reviews yet.