✅ 课程内容:

1. Issues and implications of trade debtors and debts

2. Interco company balances and transactions

3. Loan to Directors

4. Business deduction test

5. Incurred vs Provision of expenses

6. Cash rebates

7. Travelling expenses

8. Retrenchment benefits deductibility

9. Compensation & damages deductibility

10. Embezzlement of cash / theft losses

11. Stock in trade (write down vs write off)

12. Withdrawal of stock

13. Keyman insurance

14. Employee’s education benefit

15. Conference expenses

16. Books and periodicals deductibility

17. Interest restriction

18. Deductible and non-deductible interest expenses

19. Interest on borrowings to pay dividends

20. Interest paid to non-resident

21. Repairs and renewals

22. Improvements on assets

Premium Learning

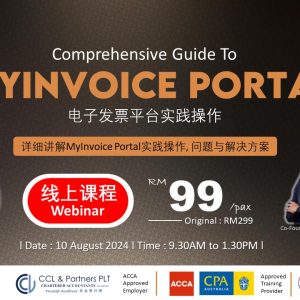

【有限公司与LLP税务全攻略 – 中级班】

RM529.00

【有限公司与LLP税务全攻略 – 中级班】

*你不能错过的讲座

近来收到很多企业老板的PM说不明白为什么他们的公司付的税务非常的高,而且明明就可以抠税的费用都不被允许!这是很多企业的痛点!赚到的都拿去给税了,而且给的不明不白!

Cynthia老师将通过1天的网上浓缩#中级课程#,以实际案例为主,教你有限公司或LLP的税务和相关的法则和抠税企业费用!绝对是学到用到!!🔥🔥

要报名的就快咯!现在开放100张早鸟价!赶快点击链接报名吧!

✅ 语言: 中文讲解 (英文讲义)

Reviews

There are no reviews yet.